Yes, there is a maximum level of extraction available to any mode of production at a given technology level.

This can only be overcome by increasing the productivity of capital (more tech) expanding into new extractive areas (imperialism) or eating your own seed corn and either reducing labour below substinence or liquidating sections of the proles or ruling class (fascism)

Or you know moving to some kind of new mode of production…

This is where the concept of commodity frontier comes to be very useful.

I believe the idea is that at some point wages become so low that the working class cannot socially reproduce itself

That is a really good way to summarize it. Just adding a little more detail since it is not directly wages which are the deciding factor, but the rate of exploitation. The rate of exploitation depends on wages but also intensity of labor, duration of the working day, etc. so there can be rising exploitation even as wages remain constant.

As an industry develops its technology, the amount of constant capital (machines, robots, AI…) increases over time. Even with fixed wages, the organic composition of capital c/v increases. And from the rate of profit equation p = s/(c+v) = (s/v)/[(c/v)+1] one can see how the rate of profit varies inversely with this organic composition c/v and directly with the rate of exploitation s/v. If c/v goes up over time, then profit falls unless there is a compensating increase in the rate of exploitation.

It gets to a point where in order to open a lemonade stand, you have to borrow $100k to license some bazingamachine that squeezes lemons super fast, so that you can compete with the other lemonade stands. Of course, borrowing $100k to earn $30/day is an abysmal rate of profit, so no one would do that. Yet that is the direction the economy goes in all industries. You see it even now with how difficult it was for mega-corporation Alphabet to break into the broadband internet with Google Fiber.

I’m actually reading Book 1 of Capital now, and chapter 6 discusses this.

Also touched upon in the Critique of the Gotha Programme, although in reverse (counterpoint to the “iron law of wages”)

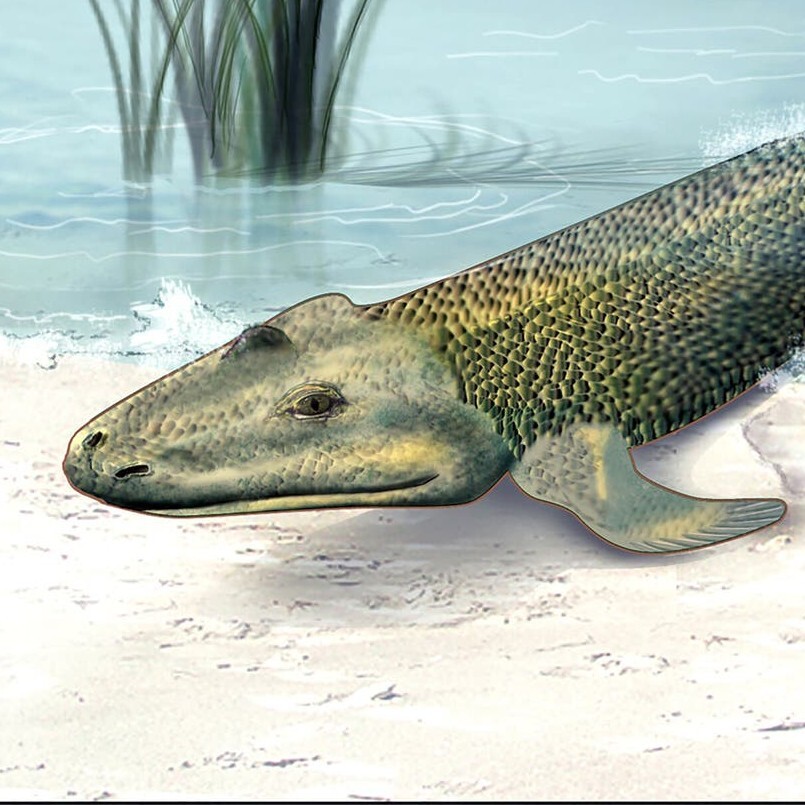

In Capitalism in the Web of Life, Jason D. Moore posits that the tendency of the rate of profit to fall is really a manifestation of the tendency of the ecological surplus to decline. He lays out how the organization of society-and-nature (they are the same thing btw) creates limits to available ecological surplus, and new technological and social innovations enable weakening modes of organization to break into new frontiers of ecological capitalization. Each of these successive reorganizations (think: mercantilism, settler-colonialsm, fossil industrialism, monopoly imperialism, financialization, etc) more and more quickly burn through the ecological surplus available to them. This is the cause of cyclical capitalist crises, as cheap food, fuel, labor, and nature are chewed up in hungrier and hungrier systems with shorter lifespans than their predecessors. Pure digital financialization is the current desperate effort to wring profit out of a situation where natural surplus is at an all time low and human demand is at an all time high.

Leaving this comment as a bookmark. My initial thought is no, the tendency for the rate of profit to fall can be derived without any reference whatever to natural resource availability. The root cause of capitalist crisis is a contradiction: capitalism compels producers to minimize labor (and resource!) inputs in order to maximize value. The ideal end of this would be a kind of singularity in which value can be produced without labor. Contradiction.

Another thought is that value is strictly non-physical, although it is embodied in physical commodities. Andrew Kliman has argued at length against what he calls a “physical quantities” or physicalist interpretation of value theory.

The same wool coat can be worth 1 hour or 10 hours (in monetary terms, say $10 or $100) depending on the development of the industry at the time. The thing that is constant, independent of all changes in productivity, is that 1 working day contains 1 working day. It may be split up among varying physical quantities, but the value produced per day is essentially constant.

Isnt that what the tendency if the rate of profit to fall is? More investment for smaller gains the more established an industry becomes. Theres a meme or short story about the last monopoly owning everything and thus not having anyone to sell said everything to, but i cant remember it.

How does this work with the velocity of money

Can you elaborate how these two need further explanation together? I’m familiar enough with both concepts, but not sure what your question is

Idk I’m kinda dumb

I did a bit more reading though and I guess as capital monopolizes everything, money changes hands less often when one corporation owns hundreds of companies, so that kinda takes the velocity of money out of the equation

It can be confusing, no shame in asking.

Is what you describe not just a cause of decreasing velocity? Why does that mean it’s no longer relevant to the discussion of the tendency to the rate of profit to fall?

I think that velocity is mostly irrelevant or at least has no causal relationship with the TRPTF. Because it’s just the organic composition of capital which changes, because less money switches hands through labour purchase and more for fixed capital. Hoarding is more likely, but that’s secondary.

But there could be other interactions I’m not thinking of, so I’d be curious what made you want to ask first?

If for nothing else then the heat death of the universe

I mean, that’s what you get, when you keep on trying to replace wage and salaried labor with more innovative property (variable for constant capital), for productive sakes…

That literally drives the profit rate’s falling tendencies

There is no limit to accumulation itself (=> profit), but there is a law of diminishing returns, so to speak

Profit itself can trend towards infinity, but the rate at which it is extracted has a tendency to fall; in theory, a low rate of profit can continue for several centuries towards that $$$

In practice, however, we have to consider that war (and other means) can contribute to a destruction of capital; that unequal trade relations exist; that climate catastrophe is on the horizon; that humans cannot live forever; and so on.

tl;dr - assuming humans live forever, there is nothing setting a limit on profit itself

Rosa Luxembourg would probably disagree with me here and claim capitalism has a tendency towards its own collapse under the weight of its contradictions. For the moment, I do not share this viewpoint; I believe capitalism can only end by workers’ self-conscious activity towards that aim and towards their own abolition.

i don’t think the two things are so different

Energy and Human Ambitions on a Finite Planet

Money is a lubricant.

There’s a joke here about ass pennies. I haven’t had enough coffee to articulate it though.

Is this a joke about coffee having a laxative effect?