We really need to start eating the parasites that talk like this. This fucking shit stain has never worked a day in it’s pathetic little life.

Ramsey was born in Antioch, Tennessee, to real estate developers.[2] He attended Antioch High School where he played ice hockey. At age 18, Ramsey took the real estate exam[2] and began selling property, working through college at The University of Tennessee, Knoxville,[2] where he earned a Bachelor of Science degree in Finance and Real Estate.[3]

Daddy gave him all he’s got and yet it’s my fault my dad was a poor artist and died young?

eat my whole asshole Ramsey

Yeah, that bio screams, “I’ve taken the easiest path available at every step in my life.”

It’s always people born to wealth who feel the most entitlement.

It’s because they are taught about personal property and ownership in a very different way.

Dude went bankrupt in the 80s.

Do you have any recipes for cooking human flesh, since you espouse cannibalism? I’m just wondering if you’re prepared to practice what you preach.

I don’t think you need specific recipes for cooking human flesh, I would think any recipe used for pork would be pretty 1 to 1

What part of that says “got his money from his dad”?

It says he sold property to put himself through school at age 18.

He’s born to real estate developers, probably helps tremendously with connections

Yeah people will hear stories like that and think go-getter, and its like even if it wasn’t a tee ball job, tell an 18 year old off the street to reproduce that outcome with no connections or cash, its not happening.

My dude what 18 year old do you know that owns property?

He was a real estate agent. It doesn’t say he owned property at 18.

You know real estate agents don’t own the properties they sell, right?

However, the upheaval millennials and Gen Z have faced may soon be behind them. The former is expected to become the “richest generation in history,” courtesy of a $90 trillion great wealth transfer in the coming decades, while younger consumers generally say they’re feeling more optimistic about their financial futures.

Don’t worry, eventually your parents will die and you’ll be able to live in the whole house not just the basement.

$90 trillion great wealth transfer. As if that money is going into the hands of people who aren’t already obscenely wealthy to begin with.

Also the the boomers with any wealth are going to live a lot longer. My boomer mom’s mom was 91 when she died, the only reason my mom is solvent is because she inherited and sold grandma’s house.

If my mom lives that long I’ll be in my mid 60s and my brother in his 50s. I’m a late Gen Xer btw.

So the timeline is at least 15-20 more years.

Subscription services will be like “sorry it’s $1k per extra seat now”

This is what neoliberalism and capitalism wants the younger generations to believe, but a large percentage of that wealth will be stolen via health care and similar predatory, exploitative systems.

And do you think the inflation caused solely by greed might be related? They need to capture that money now before it is inherited.

Reverse mortgage enters the chat.

This. My grandparents were well off and set up a trust for me and my brother.

It wasn’t much. And then all of it went into her nursing home when the dementia got so bad we couldn’t care for her ourselves anymore.

And the rich got richer

Yeah, nah.

That wealth isn’t fairly distributed. The children of rich parents will be richer, the rest of us will be worse off.

Whatever isn’t sold off for long term care, which won’t be much.

… $90 trillion great wealth transfer in the coming decades …

This only counts if your deceased parents have any wealth to transfer.

Trickle down economics in a trenchcoat.

Don’t worry, eventually your parents will die and you’ll be able to live in the whole house not just the basement.

Only if you don’t have to sell the house beforehand in order to be able to afford a nursing home for your parents

deleted by creator

deleted by creator

deleted by creator

deleted by creator

Dave Ramsey sounds like someone who has forgotten what happened last time.

They haven’t forgotten. They bought the cops. Now what do we do?

ACAB.

Pitchforks to dinner forks.

They cannot arrest or kill the entire working class, pitchforks or not. I mean, they could, but then who would work for them and make them richer? They need us and it’s going to be a very painful reminder when we remind them, one way or another.

deleted by creator

grasshoppers vs antz

We should have reminded them decades ago. Like in the 90’s when they started shipping jobs overseas for cheaper labor.

Now? Good luck convincing people to bother instead of just doing whatever the mainstream media tells them to do.

This guy was born into a wealthy family and acts like he earned it all

They always do. Its frustrating and disgusting.

Big Trump energy.

I’ve been sick of him from the first moment I met an adherent. I mentioned how I like to avoid debt and pay it down early and the person said “Oh, so you listen to Dave Ramsey?” I confessed to having no idea who they were talking about, and they swore that I was being obtuse because I couldn’t have come up with “interest sucks” on my own.

Those who are undereducated often can’t imagine that people can be truly brilliant.

Interest bad is far below brilliant

I guess we could be grading on a curve of people that view Ramsey as brilliant…

George Washington bemoaned debt

No just interest, compound interest is bad

Dave Ramsey can fuck himself. This is the same idiot that says you should give 10% of your money as tithe so that an invisible sky daddy doesn’t send you to hell to burn for eternity.

While sitting on a golden throne he made from daddies money telling other’s how to live.

Daddies money? He was literally bankrupt when he had his daughter and rebuilt everything.

Despite being born into money, he managed to take on so much risk that it society had to bail him out. Even so, I’m certain that his net worth after bankruptcy was significantly higher than the vast majority in gen-z.

Defending billionaires online is PATHETIC.

Do you know what bankruptcy does?

It doesn’t mean you have nothing. It’s designed to stop your creditors and protect what you have.

He didn’t start from scratch my dude.

Life experiences can still teach you something even if you don’t start in the same place. If he has good advice it’s good advice at the end of the day.

Add in another for trickle down, and the various forms the owner class use to divide us

Thanks, I was gonna post this if someone hadn’t.

We should teach the millionaires to fear again

I’ve always made good money, and got some good advice when I started my first job to just always put aside 10% for saving, and put that into ira/401k. I’m in my 40s now and a millionaire. I still have to work and will until retirement age.

I know I’m lucky, but you’re really barking up the wrong tree if you think simply having a million dollars makes you bad person. I’m just a saver.

These days, I don’t bat an eye at a seven figure or even low-mid eight figure millionaire. That level of wealth is attainable through individual means (hard work, saving, diligent investing, etc) and probably a significant amount of luck. It’s once you start getting into the mid to upper 8-9 figure and then billionaires where there is no way they achieved that wealth without exploitation and all the other accompanying things these people perpetrate.

Low 8 figures is my in laws. They are both doctors and busted their butts throughout their career. They could have done better had they invested better, but they still have obviously done well for themselves.

Ok then let’s teach the billionaires to fear again.

Too high. How about 100 million?

Done

Or you can start saving and investing when you’re young and be a millionaire when you retire. Compound interest is magic.

Saving what, exactly? The problem is that people arent able to maintain a standard of living, meaning they can’t certainly can’t save.

Or in simpler terms, things are becoming so expensive that they are forced to decrease their standard of living to meet their needs. This isn’t a personal finance issue.

Why don’t you buy 4 houses, you rent 3 and live in one. You can ask your parents for the capital of you don’t have it

^^^/s

Question is, was that standard of living with in their means in the first place, Americans are in 1 trillion of credit card debt. That’s insane to me, we have a spending problem that is now seemingly worse because everything is expensive.

Removed by mod

When you’re already more or less locked in to a lifestyle and then hit with record inflation, not everyone is going to just cancel their lives and live like a pauper, especially families. Yes many people are grossly irresponsible with credit card debt, but that isn’t the story for everyone. You’d have to be living under a rock to not see how insanely expensive life has become in the last few years. Sure people can sell off all of their possessions and move to Nebraska, but that isn’t a reasonable solution.

I hear yah, personally I cancelled a bunch of streaming apps, making all my food and coffee at home and been hitting thrift stores and estate sales for things I need. I know shits expensive, my car is a 2006 and it eats gas but I’m not falling for the new car trap.

People have done all of what you have mentioned here but still living paycheck to paycheck. They did it because they already know they can’t afford stuff. Now they’re starting to stop eating healthy too. You going to claim vegetables are luxury? Fuck you if you do.

Grow micro greens and tomatoes indoors. Lights are cheap af.

Do you know what the majority of debt in this country is? Health care.

Get sick, go broke.

They’re using credit cards to buy essentials like groceries and gas.

We don’t have a spending problem, we have a wage problem. And people like you blaming the poor for the circumstances that people like you put them in is gross

That sounds like we have a Health cost problem. No reason for some meds to cost so much. We also get meds advertised to us, so they spend some money on that instead of lowering prices. Our health system I agree sucks.

No thanks? Why would i be miserable right now and happy long after I’m no longer able to enjoy life? Unless you think we’re on the cusp of curing aging or something.

This is a really cute concept. Many people don’t have an extra $5 a day. Do you know what you get when you invest $5 a day over 12 years at a 4% interest rate? It’s not a million dollars.

About 28000 dollars. Even with a super safe investment that gives you 4%. S&p is like 10% a year. In that case (assuming you lose 1% to the market) you would have 36k.

If you do that over 40 years (25 to 65) you have 640k.

4%?!? where are you getting 4%?? Last time I looked at CD rates it was like 1.2%

You need to look again. I have a 5% standard savings account right now. Fed rates are very high right now.

yeah the rates are way better than last time i looked! gonna have to put some savings into good use.

- What was your first job and how old were you?

- Who paid for your education and how?

- What was your lowest salary?

- Construction at 14 for a summer.

- My parents who moved here in the 60s with practically nothing and worked their asses off in factories and cleaning houses. I didn’t go to college.

- Minimum wage.

…what’s the point of becoming a millionaire when I no longer have the same energy as I used to when I could still enjoy things?

Because you’re still going to want to live and do shit when you’re older. And you’ll pay for it in the future with what you do now.

Unless I die tomorrow and never get to use all the money I suffered for now to use later.

Don’t get me wrong, it’s a balancing act. But there’s no promise I’ll even make it to retirement. So I’m going to enjoy my now, just in case.

I thought like that in my 20s.

So is compounding health problems. Fuck retirement. Live now. Eat billionaires.

And then not be eligible for government insurance because you have too much money and go bankrupt paying for medication. Plus the million other little cuts and stabs you will take. Your kids had to go to higher ed and if you don’t help them they can’t. Someone tripped on your property and sued you.

What I have learned is this: invest in what can’t be taken away by a financial group or their judicial lackseys. Your skillset, property that has complex financial structure, your tools, your family, your reputation.

Your bank doesn’t want you custom laptop but you with your knowledge have income with it. Your insurance company doesn’t want your house that has crazy agreements about who owns it that would take a generation of lawyers to sort out. Your government doesn’t want your brother-in-law who lives abroad and runs a farm you helped buy. The guy suing you doesn’t want your professional network. What those parasites want is money without effort. So only own the stuff that requires effort to use.

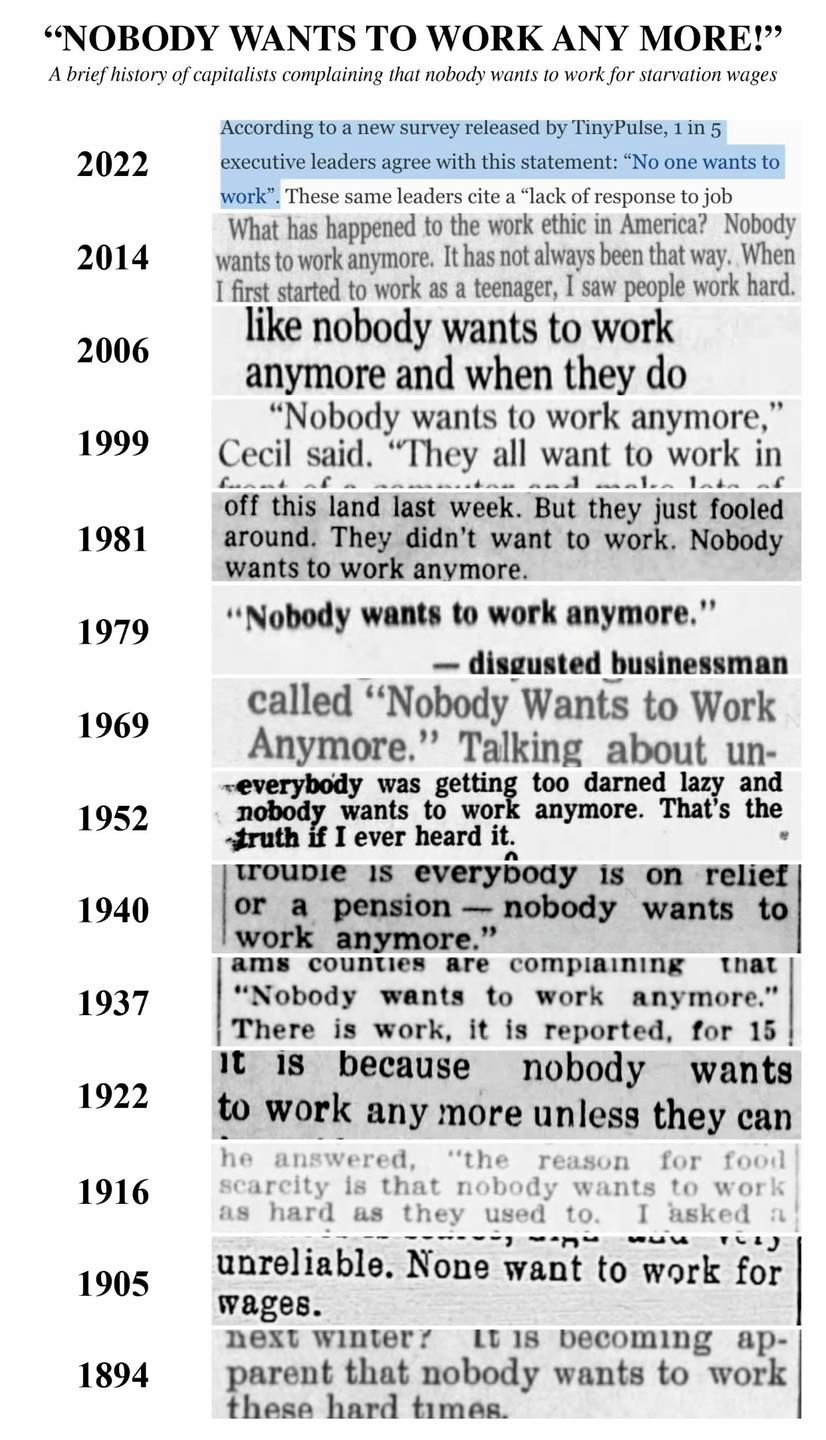

It’s not that they don’t work, it’s that their employers (boomers own the companies) don’t want to pay them

He knows this. I used to listen to his show. And in all my time listening to him, he never took on a caller who was making nine bucks an hour and struggling to make ends meet. His most frequent type of caller is a straight late twenties couple who make $140k a year, who owe maybe $25k in credit cards, and whose obvious answer to fixing the problem is to sell the thousand dollar car payment for something more basic and eat out less often. Because he knows if minimum wage workers get past the screeners, there’s nothing he can do to help. That’s a systemic problem and he knows he’s part of it. What’s he gonna tell them? Go get a better job? Cool. If everyone does that, there won’t be any of those jobs for 90% of them, one, and two, there won’t be anyone working those important low wage jobs. Someone’s gotta flip the burgers. Someone’s gotta stock the shelves. The problem is systemic. And the answer is fuck the rich.

I literally just watched yesterday a 28 year old lady with over 100k in student debt on minimum wage.

It’s not that I’ve been dealt a losing hand, it’s that my generation wasn’t dealt a hand at all, and were cussed out when we asked why the dealer left us out… Then they told us we lost the game because we were too lazy to buy our own cards to use, even though that’s not how Poker works.

I lost all respect for Ramsey when I came across a video of him saying he wouldn’t take a 0% interest million dollar loan. His opinions on finance are outrageous and dumb.

His whole thing is being anti-debt which is probably good for some people, but some people already have no debt

Yea. I have managed to never carried debt. Without that, what’s this guy got to offer me? In fact, the only thing the guy has to offer is the simplest financial advice there is: spend less than you earn.

But then a poor person comes along and says they can’t and his only advice is ‘earn more money’. Because it’s that easy, obv.

The guy is an out of touch chode who had some privileged upper middle class kid think he was the financial messiah once for saying ‘use a budget’ and let that go to his head.

For some people “use a budget” is revolutionary advice. Most people don’t literally track every dollar they spend, although apps and software make it much easier now.

Some middle class and wealthy people make a decent amount of money but spend it all on leasing a few luxury cars and going on vacation. These are the people who “budgeting” works for.

They literally cut back on eating out and save $500 - $1000 per month (“cut back”, not eliminate). They end a lease and save an extra $1000. They use this money to pay off their $50K credit card debt and it’s eliminated in less than 3 years.

Exactly. That’s who his advice is for, but he markets himself as a guru to the poor and they gobble his bullshit right up and spend all their money on his financial peace university that’s just a book full of anecdotes of wealthy people learning how to do what the poors have been forced to do all along.

True. Most poor people are pretty good at managing money because they are forced to. They just don’t have any money to manage.

Thing is, this advice is useless to anyone who straight up has no money and the rich legitimately don’t understand that situation.

Debt comes with interest. If you don’t have to pay interest it’s free money.

It’s only free money if you invest it in a way that allows you to make a return on it. If someone hands you an interest free loan and you blow it on an expensive car that actually goes down in value the second you take it off the lot, you’re losing money. That said in the right circumstances debt is an extremely useful tool. But he’s probably mostly talking to the people who don’t know how to use it that way.

An interest free loan is something you take 10 out of 10 times…the reason is simple: even in the worst of times you can accrue more than 0% interest on money.

Right now, with current interest rates, if you could get an interest-free million dollar loan, you’d essentially be able to make $50k a year out of it by just sticking it in an online savings account.

Even if they demanded that you pay all of the money back in a month, you should still take it, because you’d be netted the interest you could get out of the money in the month, and then return all of the money back to them.

Anyone saying they wouldn’t take an interest-free million dollar loan is a complete moron.

I’m well aware that that’s true if you’re financially responsible and educated in investment. I don’t think his advice is aimed at that group of people. Also in the real world people don’t hand out 0% interest loans without strings very often?

I’m well aware that that’s true if you’re financially responsible and educated in investment.

Educated in investment? Even a regular savings account will net you some return on a million dollars.

You can also be financially irresponsible in every other aspect of your life and just plunk the million dollars into a savings account and take the free money.

Also in the real world people don’t hand out 0% interest loans without strings very often?

Of course, it’s a hypothetical which is why it makes his answer as stupid as it is. He’s too absolute on debt and that makes him a clown, and that’s coming from someone like myself who paid off a mortgage with a ~4% interest rate in 3 years.

They used to for cars, but obviously that’s a depreciating asset or w/e so it’s not really the same thing.

Yeah that’s the definition of strings attached. If they’re giving you a 0% interest loan on a car, you can assume the profit margin on the sale is large enough to cover the interest, especially since car companies often own the finance companies.

It’s not free money. It’s still debt, as you have to pay it back.

Then put it in TBills or a high yield savings account. The money will still be there when you need to pay and you’ll have made interest on it the whole time.

deleted by creator

Not having debt would have been nice, but it’s kind hard when your parents shove you out the door at 17. I worked full time through college, shared an apartment with three other people, and ended up 50k to get a degree in a field that I can no longer work in (my state is currently covering up the murder of a transgender child, and as a fat hairy bearded man, I am legally required to piss in a stall next to teenage girls).

His advice works if you’re an upper middle class person with a supportive family. You can’t budget if you are making 12k a year.

my state is currently covering up the murder of a transgender child

What?

Nex.

Ah. It’s sad I had to ask for clarification as to which one.

I’m pragmatic to a fault and so his advice often makes me cringe.

However, I still have respect for him.

First and foremost because he was the gateway for my wife actually caring about our finances. And so her realizing that we can make a lot more money in the long run by not recklessly spending it now I have to credit him for…I couldn’t get through to her, but now she comes to me for most all financial advice.

However it’s also because for a lot of people their relationship with money is more emotional than it is rational, and for them he is very good. Watching my wife go through the transformation gave me an appreciation for what he preaches, even if it isn’t logically the best path, it’s often the best path for a lot of people.

What is so bad about living with your parents? That’s still the norm in many parts of the world. For some reason western countries, and especially America, have exaggerated the benefits of being financially independent, as if shared resources were some kind of failure.

I beg to differ. The only people who lose when we share resources are the capitalists.

I’ve got a few friends in their thirties who live with their parents and the whole family is very happy. And although my kids are only six and three, I can’t imagine any reason why I wouldn’t want them to continue living in my house for as long as they needed support.

We all need support. It’s not a shame. It’s an asset more valuable than property, imho.

you might be gay and have to move out, assuming they didn’t throw you out as a teen. even if you’re straight your parent’s won’t respect you as an adult if you live with them and impose restrictions on your lifestyle. you also have to appease them in whatever crazy shit they force on you because they can kuck you out if you refuse

Did that happen to you?

I’m a gen x, and I don’t want to work. I mean really, who does? Who would rather work than spend time with their family and/or see the world? I work because I have to to survive.

People want to work if:

- it is meaningful to them

- their work is a mean to do something meaningful to them.

If you work to survive, there is no prospect to advance or do something fun/meaningful, then why the fuck should people want to work?

And Ramsey is kidding himself, is work is not that hard. So it’s fucking rich coming from someone that peddle his shit to make money.

“want to work”? that’s only for actual humans, you are a parasite leaching off the work of the people who are actually productive, the shareholders, and if they all go hide in a secret valley gated community the world will collapse as they invent a perpetomobile outside the “laws of nature” imposed by the government

(everything up to the perpetomobile is actually held beliefs among these people, just the laws of nature being enforced by the government is a bit of a gag)

I love working! … when I’m self-employed. Knowing that what I’m doing is likely to actually make a difference for someone other than a rich fuck is incredibly motivating.

Removed by mod

I like to imagine this means “fixed that for thee.”

Dave “I fire people that have sex out of wedlock” Ramsey? Who cares what that religious nut have to say?